My Crypto Trading Encounter

I first dabbled with Trading and Technical Evaluation again in November 2012, after I first found myself in Currency Trading. In the past, I had been released to an Automatic Crypto Trading Program which could rake in inactive revenue around 5-10% per month, and employed a Martingale (increasing) scheme for trading. In just less than THREE weeks, half my accounts went break since I had been using too large of a risk-benefit environment, in conjunction with with an extremely explosive GBP/USD marketplace on the 5th of Jan 2017.

I first dabbled with Trading and Technical Evaluation again in November 2012, after I first found myself in Currency Trading. In the past, I had been released to an Automatic Crypto Trading Program which could rake in inactive revenue around 5-10% per month, and employed a Martingale (increasing) scheme for trading. In just less than THREE weeks, half my accounts went break since I had been using too large of a risk-benefit environment, in conjunction with with an extremely explosive GBP/USD marketplace on the 5th of Jan 2017.

I have done a reasonable share of Financial lessons within my my Company studies, and had a fundamental knowledge of the Collateral and foreign exchange markets, and believed that I understood what I had been performing. But oh was I so wrong! Following this drawback, I started to find out on the topic of Specialized Evaluation to supplement my Vehicle Trading, and moreover, to actually comprehend what I used to be trading in.

I continued using the Crypto Trading Program for another 10 weeks up till November 2017, as I started to change away my funds in to Bitcoin after eventually turning a profit in September. Since that time, I’ve been following Bitcoin more carefully, and have now been very curious in figuring out the best way to trade Bitcoin and how to use leverage. I also tried several different brokers I found on this page about bitcoin brokers with flexible leverage.

Getting Started

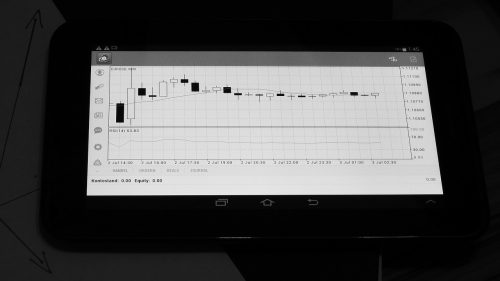

Back while I used to be studying more about Currency trading, I visited Forex college at Babypips, and learned a few of the basic principles of graph studying and trading, including studying candles and trading theories. Sadly, I dropped away someplace through Elementaryschool, after they lost me featuring a myriad of different index numbers I couldn’t find the employment for. On the flip side, I however do believe Babypips is an excellent re-Source, specifically for novices that are eager to find out the way to business and better comprehend the Bitcoin marketplace. A good crypto trading book is very helpful and can support you to become a pro trader pretty fast.

Now, because since I have created my first few stress purchases and offers and misplaced some Bitcoins trading, I’ve been selecting picking right on up again on Specialized Examination and trading schemes. Im maybe not a specialist at so, and neither in the event you choose my words as expense guidance, but Im here to discuss a number of my applying for grants Bitcoin trading, as well as I am hoping it’s of fantastic help you!

Understand the Basic Principles of Trading

BTC is now often used for trading and in general in the finance industry. Read the article here to get an idea of the most useful btc fintech services.

BTC is now often used for trading and in general in the finance industry. Read the article here to get an idea of the most useful btc fintech services.

If youre a trading newbie, first point you need to discover would be technical chart analysis. Graph designs provide signals of a direction where price will probably go in a single way or still another when the routine is complete. Identity prefer to to create your focus three graph designs that may seem quite frequently. Additionally, I required enough time to demonstrate how these link to Bitcoin trading with all the planning resources I take advantage of on TradingView. Love!

Second, still another evaluation program I believe is invaluable, is the Fibonacci Expansion. Leonardo of Pisa is quite hard to know, and way more to graph with Bitcoin as a result of insufficient accessible resources which allow because of it. But in substance, the Fibonacci series is an original chain of figures which provides the total of both amounts before it, and is the deravitive of the Fantastic Percentage. Folks name them the wonder numbers, and quite competently thus, as theyre current all all through Character.

Jason Stapleton gives the key of Fibonacci Trading; that would be to recognize that Leonardo Of Pisa (expansion) is purely a instrument. But when used correctly, as well as in combination with additional indexes, it could present enormously lucrative, high compensation reduced risk trading opportunities.

Finally, Identification like to share a trading pattern known as the Elliott Waves Principle. It stresses an awareness of Invest Or Mindset, and describes why prices fluctuate in zigzag styles. In the event you believed Leonardo was demanding to comprehend, allows have Babypips place this in view. Babypips instructs Leonardo Of Pisa in elementaryschool Quality 3, where as Elliott Influx is educated in Summer School. For the reason that perception, Eliott Influx will be an excellent notion to master and comprehend, as a nutritional supplement to your own fundamental comprehension. Click the hyperlinks over to study and find out mo-Re about equally hypotheses.

Posted in News by Allan with comments disabled.